Practical Tips on Selecting Payment Options for eCommerce Sites

So you have an eCommerce site. You have great products to sell, and you know how to run a business. There are many factors to consider, and you’ve got them all covered.

One thing that many eCommerce business owners are concerned with are payment options. This aspect of online stores can be problematic because of the very nature of the business: online shopping has to be able to offer customers different ways of paying for their purchases. Otherwise, your online store might lose business.

Looking at payment options for your eCommerce site is crucial for success, and there are many factors that have to be considered in selecting them.

Tips on selecting payment options

A major factor is the ease and cost of implementing your payment system. However, this factor is solely based on your needs. What is as important is what your customers will find most beneficial. When people shop online, they think about:

- Are the payment options easily accessible?

- Are the payment options secure?

These are the things that you, as the shop owner, have to think about as well.

What are the popular payment options today?

The obvious ones are PayPal, Google Wallet, and merchant accounts. However, they all have their downsides, especially when it comes to transaction fees. There is also the bigger issue of having to link a credit card to the payment method, which many consumers find disconcerting, especially with the surge of hacking, credit card fraud, and other security issues.

When selecting payment options for your eCommerce site, take note of all the concerns above, and weigh the costs and benefits – both for you and your customers.

A new method of payment processing

Although the current payment methods work – millions of dollars have been spent using these methods – there is a new method of payment processing that just might take over the eCommerce scene.

Called IFAN Financial Inc. (OTCBB: IFAN), this new technology does away with the issues faced by current online payment methods, the most obvious of which is linking credit cards to payment gateways. Contrarily, IFAN Financial Inc. (OTCBB: IFAN) links only to debit cards, which basically functions as cash, and without the merchant obtaining any sensitive financial information about the customer.

More so, IFAN Financial Inc. (OTCBB: IFAN) has the following advantages:

- Lower costs. Merchants only pay 0.7% as opposed to PayPal’s 3% per transaction.

- No additional fees. Since debit cards are used, there is no chance of having chargeback fees. When there’s money in the debit card account, the transaction will go through. When there’s no money, no transaction will happen.

- Payment is immediate. IFAN Financial Inc. (OTCBB: IFAN) immediately pays the merchant for each transaction, as opposed to other methods, which may take days before the merchant receives the money.

How does IFAN Financial Inc. (OTCBB: IFAN) work?

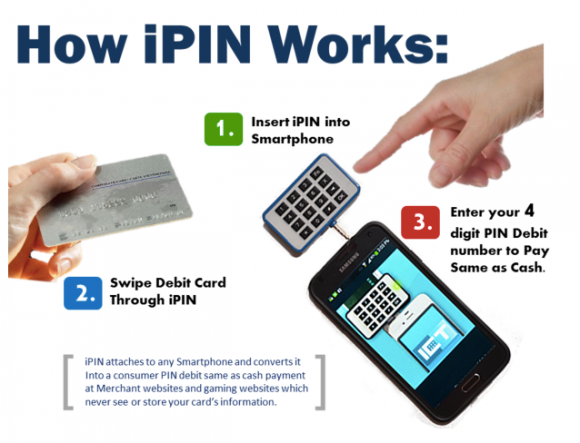

The technology makes use of a small device, iPIN Debit, that is plugged into your phone or computer. After you’ve plugged iPIN in, you swipe your debit card through iPIN. You then enter your debit card PIN to pay – just like cash.

It’s as simple as that.

With the security, convenience, and low cost that iPIN Debit offers, it wouldn’t be surprising to see it being offered as a payment option in many eCommerce sites in the near future.

So, if you’re running an eCommerce site, you should really look at this payment option.

Learn more about the technology by watching the video below.